[ad_1]

Currencies / Bitcoin

May 31, 2024 – 07:52 PM GMT

By: Nadeem_Walayat

Dear Reader

This article is part 2 of 2 of my recent extensive analysis – Stock Market, Interest Rates, Crypto’s and the Inflation Red Pill which was first made available to patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before next rises to $10 per month for new sign-ups. https://www.patreon.com/Nadeem_Walayat.

Contents

Stock Market Trend Forecast

Swings Analysis

AI Stocks Portfolio

TESLA

Why US Interest Rates are a Nothing Burger

Stocks Bull Market Smoking Gun

Time to take the RED Pill

Crypto Correction

Bitcoin Trend Forecast

Bull Market Tops

Crypto’s Exit Strategy

Coinbase MSTR 2.0

So much for the Rise of China Narrative

Crypto Correction

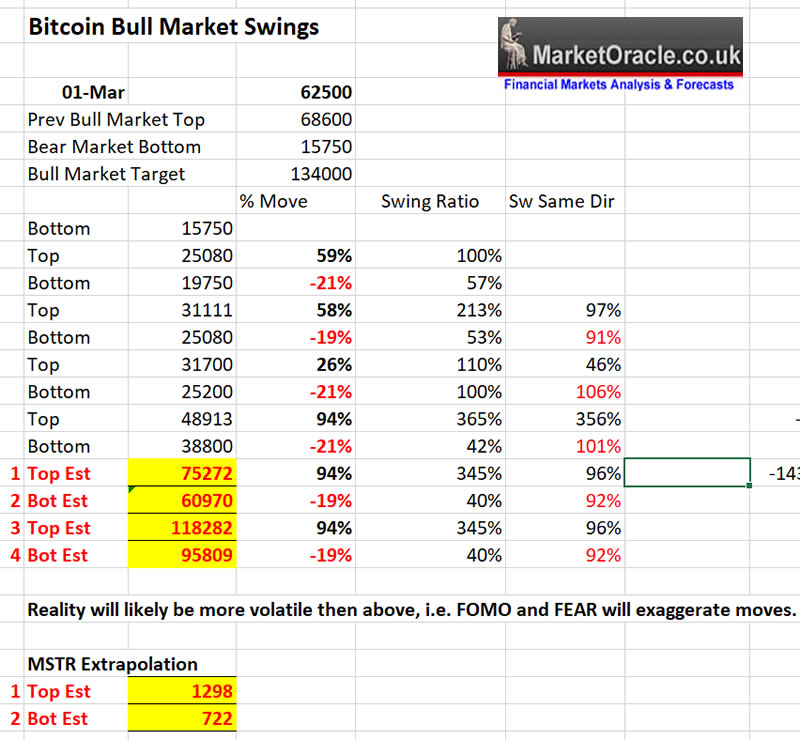

Whilst the S&P continues to grind higher the same cannot be said for the crypto markets over the past few days. Bitcoin hit $74k and then did an abrupt U-turn by dropping to my $61k target as per my last analysis.

BTC Targets – Rally to $75k and then corrects to $61k, check, check, what’s next? the primary big picture is to target a trend to $118k.

In terms of current state then the crypto’s don’t look quite done yet to the downside so the next target for BTC is $56k to kill more leveraged longs. One thing is for sure there are a lot of over leveraged traders out there who are getting their accounts nukes, this is how the exchanges make their money by wiping out leveraged longs and shorts!

As I often warn, do NOT use LEVERAGE!

What am I doing? Accumulating more BTC and ALT’s as they drop.

Crypto’s now total about 8% of my portfolio after heavy selling of MSTR down to 11% of my peak position. Other selling was in Solana and AVAX and limited selling of BTC when it popped over $72k. that I am now re-accumulating having increased my stake in MSTR to 20% on Tuesdays drop below $1300, with heavier buying set for around $1000 and below.

Bitcoin Trend Forecast

The bottom line is that Bitcoin continues to target a trend to above $100k where my base case is for Bitcoin to trade to $134k, where the only change to my expectations is for the target to be achieved this year, likely during October 2024. so much earlier than anyone was expecting 6 months ago due to the effect of the ETF locusts devouring bitcorn on a daily basis.

Bitcoin Trend forecast – Last Chance to Get on Board the Bitcoin Crypto Gravy Train – Choo Choo!

So here’s my Bitcoin gift (trend forecast) that on the current price of $27k, Bitcoin will at least near X4 to $98k and likely a lot more than that, given that there will soon be a flood of Bitcoin ETF’s hovering up limited supply of the NSA’s, I mean Satoshi Nakamoto’s crypto baby.

Meanwhile Michael Saylor is engaged in Financial Voodoo. as what usually happens when a company prints more shares i.e. dilutes existing shareholders is for the stock price to FALL, which we got a taste of on Tuesday and likely targets a trend to under $1000 should the crypto correction continue.

Bull Market Tops

Here’s another little study into market dynamics. that shows when markets put their tops in during the 2021 bull market as a rough guide of what to expect for the current bull markets.

Firstly I doubt we will get the twin tops pattern that we got during 2021 that fooled everyone into thinking BTC $100k was just around the corner. Nevertheless what happened during 2021 will likely rhyme for this bull market.

The key thing that stands out, which I had already pointed out before is that MSTR will be the first to top! So a big warning sign that the end is neigh is when BTC goes up and MSTR goes down!

Secondly after Bitcoin tops there will be short burst of alt-season, maybe spanning a few weeks when the degenerative gamblers sell bitcoin to pump alt coins to the moon in a final attempt to make profits,

Thirdly the stock market will top some months AFTER the bitcoin and crypto market tops. Which makes sense, given that money will flow out of crypto’s and into stocks and probably housing as all those who managed to exit he crypto mania will plow their gains into other assets such as stocks and housing given that crypto winter follows the bull market.

So MSTR tops first, then Bitcoin, then Alt coins and then some months later the S&P.

As for the ETF’s narrative, folks have somehow forgotten that ETF investors can also SELL their ETF’s! i,e. take profits. It’s not a one way traffic as apparently many are assuming them to be, the flows can and probably will reverse direction in response to BTC price action.

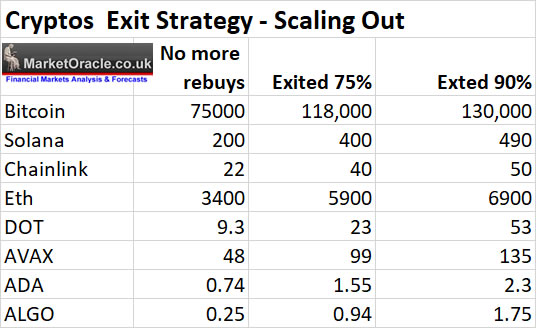

Crypto’s Exit Strategy

I am already lightly scaling out as crypto’s rise, with limited rebuy’s typically 20% to 30% below where I sold. However these are the price points where I will no longer do rebuy’s and thus as prices rise my exposure to crypto’s will reduce as a rough guide for where my portfolio will stand should these prices materialise. Just as I recently demonstrated with MSTR where I sold out of 90% of my MSTR during the rally to $1860 and to date having bought back 10% to stand at a position size of 20%.

So if the BTC price continues to trend above $75k I will gradually reduce the amount of BTC I hold with no buy the dips above $75k.

Of course nothing ever goes completely to plan, as if the bull markets show signs of terminating earlier, I may decide to accelerate reduction in exposure or refrain from re buying the weaker crypto’s such as DOT. So this is a rough guide, where the key point is to HAVE an EXIT strategy without which one will end up giving up all of ones gains. At the end of the day a bird in the hand is worth two in the bush.

And no I have no exit strategy for AI tech stocks, those are investments whilst crypto’s are high risk trades.

Coinbase MSTR 2.0

Coinbase to start doing what MSTR is doing, i.e. sell bonds (dollars) to buy bitcoin.

Plans to raise $1 billion through a unsecured convertible debt offering, conversion in 2030.

So you may want to hold onto those Coinbase shares.

And there are a lot of entities out there looking at what Saylor is doing with a view to doing similar, sell dollars for bitcorn which drives the dollar price of bitcorn higher.This is why one needs to be careful of not getting carried away with expecting to buy Bitcoin on corrections because a lot light bulbs are going off in many corporations, the bitcoin black hole could become a reality!

UK Tax Year Ends 5th April – To do list

Add to your ISA

You can add 20k per adult, use it or lose it. Not opened one for current tax year? Trading 212 is a Good low fee ISA that I use, open one with my link, and we will both get a free share worth upto £100.

https://www.trading212.com/invite/16aA4Pdcoi

SIPP – FREE MONEY

Add to your sipp upto the max that your earnings allow to get 20% tax relief on the gross.

i.e. deposit 1000 cash get 250 from HRMC (1250 gross).

Higher rate tax payers can claim an extra 20% back via self assessment. Max gross is £60k

Folks with NO income (including children) can deposit 2880 to get 720 (3600 gross).

Free money – Use it or lose it!

So much for the Rise of China Narrative

https://www.telegraph.co.uk/business/2024/01/31/china-never-overtake-usa-worlds-biggest-economy-citi/

This is the problem with econofools, they only tend to look at stuff that backs up their thesis rather than that which actually matters. Even billionaires such as Ray Dalio can fall into this trap.

EconoFools Starting to realise they have been Wrong About China for decades! The so called Chinese century. China over taking the US was never going happen as China stalls and the US economy accelerates away….

The EMPIRE was never going to allow China to over take it! The US has done away with every competing Empire, Friend or Foe!

Even Billionaires such as Ray Dalio who swallowed the Rise of China koolaid and plowed thousands into producing fantasy theories for why China was destined to replace the the US as the Global Empire in response to which I did a my own rebuttal analysis and video illustrating why Ray Dalio was wrong and that instead of the Rise of China we were looking at peak China.

In fact Ray Dalio may finally be recognising his error hence he seems to be seeking out explanations for why he got it so badly wrong .

I am sure if not already then Ray will soon become a Patron 🙂

This article is part 2 of 2 of my recent extensive analysis – Stock Market, Interest Rates, Crypto’s and the Inflation Red Pill which was first made available to patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before next rises to $10 per month for new sign-ups. https://www.patreon.com/Nadeem_Walayat.

Access to my latest analysis – AI Will Turn Everyone Into Gamblers! The Greatest Wealth Transfer In History is Coming…

CONTENTS

Stock Market Inverted Seasonal Trend

China NEW STOCKS BULL MARKET!

Hyper Sensitive Markets as AI Disrupts Everything, Including Itself!

Learn How to Accumulate and Distribute

Beat FOMO and FUD with EGF Direction of Travel

MEDIFAST – Disrupted by Weight Loss Drugs

Counting Down to Nvidia Earnings

AI Stocks Portfolio Spreadsheet

RECESSION 2026?

Stocks Portfolio For A Recession of Sorts

AI Will Make Everyone Poor!

SPECULATING!

The Future of Mankind – You are Being Sold a Lie!

Universal Basic Slave Income is Coming….

Fake Full Employment

Billionaire Nazis are in Charge!

How to Get Rich University

They Want Your House!

The Greatest Wealth Transfer IN History

…

[ad_2]

This article was originally published by a www.marketoracle.co.uk . Read the Original article here. .

Disclaimer:The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website’s content as such. BitcoinNews.best does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.