[ad_1]

This post covers the basics of Bitcoin trading. It will help you get familiar with basic terms, understand different ways to “read” the market and its trends, make a trading plan, and learn how to execute that plan on Bitcoin exchanges or via a Bitcoin ETF.

Don’t Like to Read? Watch Our Video Guide Instead:

Jump to: Bitcoin resource section

Bitcoin Trading Summary

Successful Bitcoin trading involves buying low and selling high. Unlike investing, which involves holding Bitcoin for the long run, trading involves trying to predict price movements by studying the industry as a whole and price graphs in particular.

People use two main methods to analyze Bitcoin’s price – fundamental analysis and technical analysis. Successful trading requires a lot of time, money, and effort before you can actually get good at it.

In order to trade Bitcoin, you’ll need to do the following:

- Open an account on a Bitcoin exchange (e.g. CEX.IO, eToro, Bitstamp)

- Verify your identity

- Deposit money into your account

- Open your first position on the exchange (i.e., buy or short-sell)

eToro disclaimer: This ad promotes virtual cryptocurrency investing within the EU (by eToro Europe Ltd. and eToro UK

Ltd.) & USA (by eToro USA LLC); which is highly volatile, unregulated in most EU countries, no EU

protections & not supervised by the EU regulatory framework. Investments are subject to market risk,

including the loss of principal.Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

That’s Bitcoin trading in a nutshell. If you want a really detailed explanation, keep on reading.

- Bitcoin Trading vs. Investing

- Trading Methods

- Analysis Methods – Fundamental vs. Technical

- The ‘Stock-to-Flow’ Model

- Bitcoin Trading Terms

- Reading Price Charts

- Common Trading Mistakes

- Frequently Asked Questions

- Conclusion

1. Bitcoin Trading vs. Investing

The first thing we want to do before we dive deep into the subject is to understand what Bitcoin trading is and how it is different from investing in Bitcoin.

When people invest in Bitcoin, it usually means that they are buying Bitcoin for the long term. In other words, they believe that the price will ultimately rise, regardless of the ups and downs that may occur along the way. Usually, people invest in Bitcoin because they believe in the technology, ideology, or developers behind the currency.

Bitcoin investors tend to HODL the currency for the long run (HODL is a popular term in the Bitcoin community that was actually born out of a typo of the word “hold”—in an old 2013 post in the BitcoinTalk forum).

Bitcoin traders, on the other hand, buy and sell Bitcoin in the short term whenever they think a profit can be made. Unlike investors, traders view Bitcoin as an instrument for making profits. Sometimes, they don’t even bother to study the technology or the ideology behind the product they’re trading.

Having said that, people can trade Bitcoin and still care about it, and many people out there invest and trade at the same time. As for the sudden rise in popularity of Bitcoin (and several altcoins) trading – there are a few reasons for that.

Firstly, Bitcoin is very volatile. In other words, you can make a nice profit if you manage to anticipate the market correctly. Secondly, unlike traditional markets, Bitcoin trading is open 24/7. Most traditional markets, such as stocks and commodities, have an opening and closing time. With Bitcoin, you can buy and sell whenever you please.

Finally, Bitcoin’s somewhat unregulated landscape makes it relatively easy to start trading—without the need for long identity verification processes.

2. Trading Methods

While all traders want the same thing – profit – they practice different methods to generate it. Let’s review some examples of popular trading types:

Day trading

This method involves conducting multiple trades throughout the day and trying to profit from short-term price movements. Day traders spend a lot of time staring at computer screens and usually close all their positions by the end of each day.

Scalping

This day-trading strategy is becoming popular lately. Scalping attempts to make substantial profits on small price changes and is often likened to “picking up pennies in front of a steamroller.”

Scalping focuses on extremely short-term trading and is based on the idea that making small profits repeatedly limits risks and creates advantages for traders. Scalpers can make dozens—or even hundreds—of trades in one day.

Swing trading

This type of trade tries to take advantage of the natural “swing” of the price cycles. Swing traders try to spot the beginning of a specific price movement and enter the trade then. They hold on until the movement dies out and take the profit.

Swing traders try to see the big picture without constantly monitoring their computer screens. For example, swing traders can open a trading position and hold it open for weeks or even months until they reach their desired result.

3. Analysis Methods: Fundamental vs. Technical

Can I predict Bitcoin’s price movement?

The short answer is that no one can really predict what will happen to the price of Bitcoin. However, some traders have identified certain patterns, methods, and rules that allow them to make a profit in the long run. No one exclusively makes profitable trades, but here’s the idea: at the end of the day, you should see a positive balance, even though you may have suffered some losses along the way.

When analyzing Bitcoin (or anything else they want to trade, for that matter), people follow two main methodologies: fundamental analysis and technical analysis.

Fundamental analysis

Fundamental analysis is used to predict the price by looking at the bigger picture. In Bitcoin, for example, fundamental analysis evaluates Bitcoin’s industry, news about the currency, technical developments of Bitcoin (such as the lightning network), regulations around the world, and any other news or issues that can affect the success of Bitcoin.

This methodology looks at Bitcoin’s value as a technology (regardless of the current price) whilst considering relevant outside forces in order to determine what will happen to the price. For example, if China suddenly decides to ban Bitcoin, this analysis will predict a probable price drop.

Technical analysis

Technical analysis tries to predict prices by studying charts and market statistics, such as past price movements and trading volumes. It tries to identify patterns and trends in the price and, based on these, deduce what will happen to the price in the future.

The core assumption behind technical analysis is this: Regardless of what’s currently happening in the world, price movements speak for themselves and tell some sort of a story that helps you predict what will happen next.

So, which methodology is better?

Well, as I said in the previous section, no one can accurately predict the future. From a fundamental perspective, a promising technological achievement might end up as a flop. From a technical perspective, the graph just doesn’t behave as it did in the past.

The simple truth is that there are no guarantees for any sort of trading. However, a healthy mix of both methodologies will probably yield the best results.

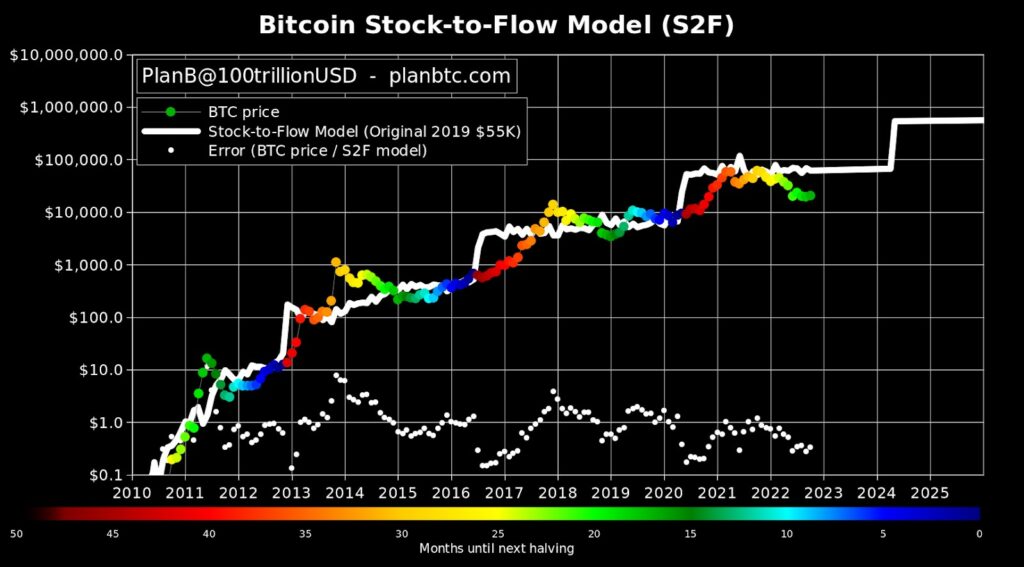

4. Stock-to-Flow Model

What is Stock-to-Flow?

The stock-to-flow model is a pricing model that predicts the price of Bitcoin based on the relative rate of new supply – that is, how much new Bitcoin is being created compared to how much Bitcoin already exists.

The model is based on scarcity and was originally applied to precious metals such as gold and silver. The word “stock” refers to the already-existing supply of the asset, while “flow” refers to the new supply entering the market.

The underlying principle of stock-to-flow answers the following question: At the current rate of supply, how long would it take to replace all units of the asset already on the market?

For Bitcoin, this question is surprisingly easy to answer. Thanks to the hard-coded rate of supply in the Bitcoin protocol, we can estimate the stock-to-flow ratio at any point in the future with decent certainty.

Stock-to-Flow in practice

At the time of writing, the circulating supply of Bitcoin is around 19.5 million coins. At the current rate of new supply – around 900 BTC per day – it would take over 59 years to replace all of these 19.5 million bitcoins that are already on the market.

This is a good way to picture how scarce Bitcoin really is.

Of course, we know that it’s even more scarce than that calculation implies; Bitcoin really has a maximum supply of 21 million coins.

By combining this knowledge of supply with historical Bitcoin pricing data, we can create a formula that predicts the future price of Bitcoin based on that stock-to-flow ratio – and this is how the stock-to-flow pricing model came about.

The model was formalized and published by “PlanB” – a prominent crypto analyst who is supposedly a highly experienced former Dutch institutional trader.

Source: Planbtc.com

Does the model work?

The S2F model looks quite good at first glance, with the Bitcoin market price appearing to roughly follow estimations quite well. Upon closer inspection, however, the actual price has deviated very far from the model at times during its boom-and-bust cycles.

Overall, it could be argued that the model serves as a good baseline for a “fair” Bitcoin price, which would be best used as a guide.

For example, if the actual price is much higher than the predicted price, it may be a good “sell” indicator. Conversely, if the actual price is well below the model price, it may be a good “buy” indicator.

Praise and criticisms

Overall, the model has received more or less an equal amount of praise and criticism from the general community and more notable figures alike.

Most notably, Ethereum founder Vitalik Buterin was quoted saying he tends to dislike such models due to the fact they “give people a false sense of certainty and predestination that number-will-go-up…”

This is a fair conclusion, as there are no “downward” portions of the stock-to-flow model’s price curve.

It has also been widely acknowledged that the model cannot account for various external micro- or macro-economic factors, such as black swan events, significant inflation events, financial crises, or major regulatory changes.

Is it worth using?

Overall, the model is a good rough guide for long-term price predictions, taken with a pinch of salt due to its inability to capture external macroeconomic factors.

Its best application may be as a form of indicator when compared to the current market price, signaling whether Bitcoin is significantly over-priced or under-priced at any point in…

[ad_2]

This article was originally published by a 99bitcoins.com . Read the Original article here. .

Disclaimer:The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website’s content as such. BitcoinNews.best does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.