[ad_1]

Bitcoin price is trending higher after plunging lower last week. BTC price remains technically bearish below $60,000 and the $64,000 line

It has been a rollercoaster ride week for Bitcoin. After sinking to as low as $53,500, sellers didn’t sustain the momentum, allowing bulls to flow back, plugging the bleed.

At press time, prices are trending higher, approaching $60,000.

(BTCUSDT)

This means traders who panicked and dumped their BTC holdings regret it. Meanwhile, leveraged short sellers who sold after July 4 are also underwater.

Even so, buyers are not out of the woods, and there is weakness, at least from a technical perspective.

Bitcoin Firm: Here’s Why Patience Is Key

Though price action might be bearish from a top-down preview, one analyst, citing on-chain developments, thinks the best current approach is to “wait.”

A short-term squeeze could form, forcing sellers to exit by buying back at higher prices, lifting prices higher.

(Source)

However, bulls are far from regaining control until there is a close above $60,000, ideally with rising volumes.

A close above the $60,000 psychological hurdle and a technical resistance point is crucial as it could anchor the next leg up toward $63,000.

At press time, the Bitcoin Exchange Flow Multiple (30D/365D) metric shows that the market is indecisive and at its lowest level in six years.

The Bitcoin exchange flow multiple compares the average daily exchange outflow in the past month to the average over the last year.

The contraction points to decreasing exchange activity, meaning investors are on the sidelines, waiting for clean signals before jumping back.

Note that this does not mean prices have to rise for the metric to rise. A drop from spot levels, breaking July lows toward $50,000, could spark activity.

DISCOVER: How to Buy Bitcoin Anonymously – Without KYC – July 2024

Whales Accumulating But Bitcoin Must Break $64,000

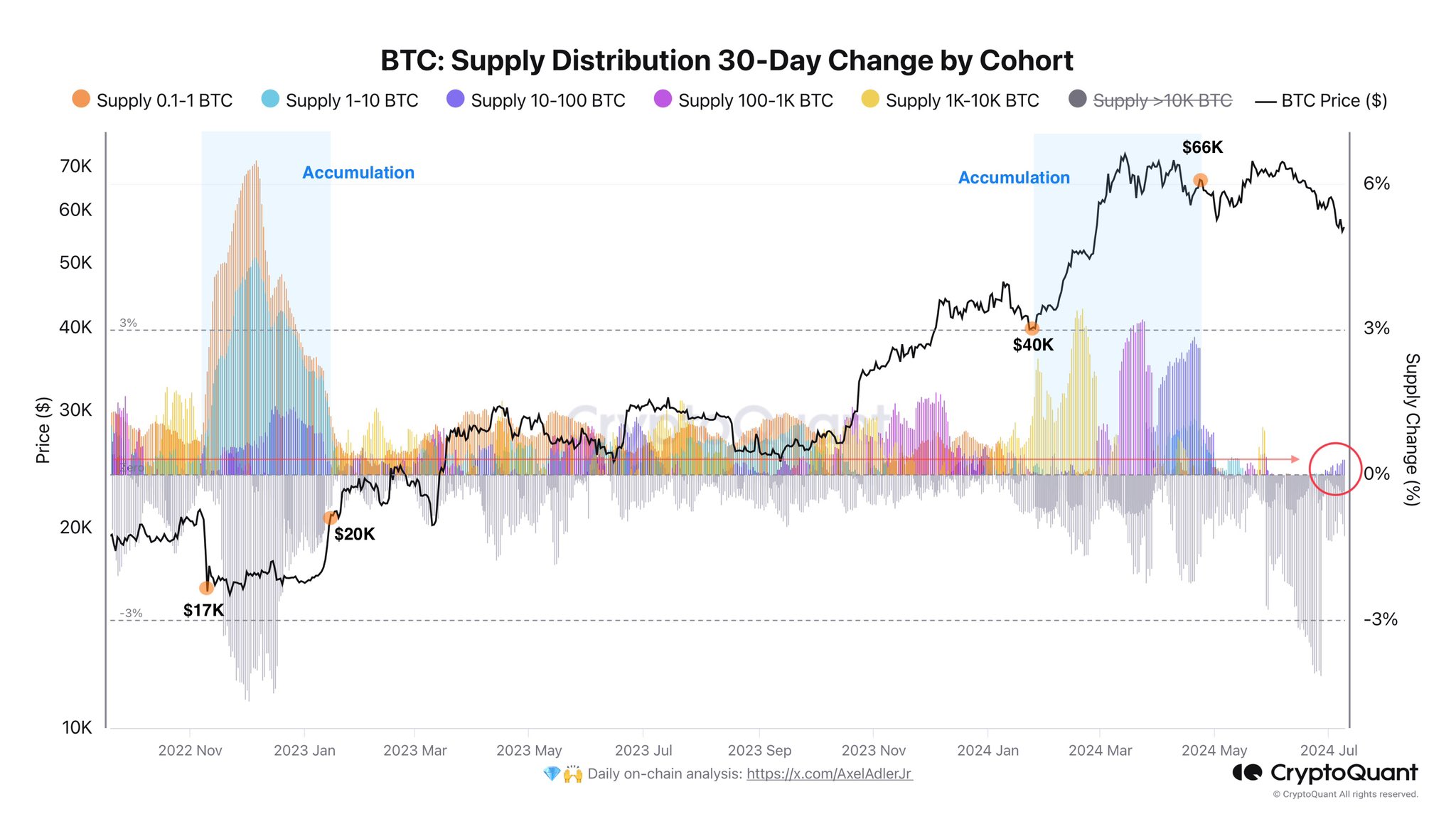

While exchanges struggle for activity, entities holding between 10 and 100 BTC have been buying, increasing their stash.

(Source)

Since the approval of spot Bitcoin ETFs in the United States in January, these whales have been stacking up coins between the $40,000 and $66,000 range.

Though these whales might be exchanges, as seen from their activities when prices broke below $60,000, the recent influx of fresh capital via spot Bitcoin ETFs is a net positive for buyers.

Still, traders have a reason to avoid the markets, at least for now, or better yet, to align with the dominant bearish trend.

With prices trending at around $58,600 at press time, it is way below the Bitcoin Short-Term Holder Cost Basis stands at around $63,900.

(Source)

The short-term cost basis is the average purchase price of BTC for holders who bought the coin in the last 155 days.

If prices continue falling, recoiling lower from spot rates, these holders might panic sell, exiting for cash or USDT, thereby accelerating the dump.

EXPLAIN: XAI Crypto Set For Major Unlock Here’s What it Means For XAI Price

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

[ad_2]

This article was originally published by a 99bitcoins.com . Read the Original article here. .

Disclaimer:The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website’s content as such. BitcoinNews.best does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.